On the heels of the latest credit cycle, a culmination of factors has led to a lack of liquidity for shareholders in late-stage venture-backed companies. In turn, we’re seeing a deep pool of sellers emerge including early-stage GPs, employees, and other shareholders oftentimes leading to heavily discounted opportunities. With IPO proceeds down more than 30% year-over-year in 20231, the average company staying private for 12+ years, and VC-fund distribution velocity continually declining vintage over vintage, we expect direct secondary supply growth to continue to scale rapidly over the coming years. We believe that this dynamic has created the best environment to invest in category-leading companies, at fair pricing, in the 10+ years. Let’s dive in.

Key Takeaways

- In the absence of traditional liquidity sources, namely IPOs and M&A, shareholders of late-stage private companies are selling shares at deep discounts to both the last public valuation and intrinsic value based on public market comps.

- The narrative around accessing liquidity through secondary transactions is changing quickly, and we anticipate secondary supply growing at nearly 30% per annum through 2026.

- Direct venture secondary exposure has unique benefits compared to traditional venture investing including reduced duration, competition, and volatility.

Dynamics Leading to the Opportunity

In 2021, as the credit cycle peaked, investors abandoned valuation discipline, driving up prices across risk assets. Public SaaS EV/NTM revenue multiples surged to around 15x, nearly double the 5-year average. This lack of discipline was even more pronounced in private markets, with funding rounds often reaching multiples of 50x or even 100x EV/NTM revenue, driven by speculative fervor rather than sound investment decisions, in our eyes.

During this period, savvy founders capitalized on favorable conditions to raise significant capital at favorable valuations. A key driver in the opportunity within secondaries is the fact that the highest-quality companies built fortress balance sheets during the days of cheap capital, and even today, very few have plans to raise primary rounds of financing before going public.

The early 2022 market correction triggered several shifts further reducing the likelihood of shareholders seeing liquidity near-term:

- Public market multiples plummeted by 60-70% to approximately 5x EV/NTM revenue multiples, necessitating a significant increase in revenue for companies to maintain their valuations.

- Growth rates decelerated, and the enterprise sales cycle lengthened, prompting companies to reassess their growth and investment strategies.

- Founders were reluctant to raise capital in challenging market conditions at risk of re-pricing the company. As mentioned above, high-quality companies extended their runway, making fundraising less urgent.

- The public market became an unviable option for even the most promising private companies, as it applied harsher valuations than private markets. The IPO window is firmly closed.

A Liquidity Starved Market

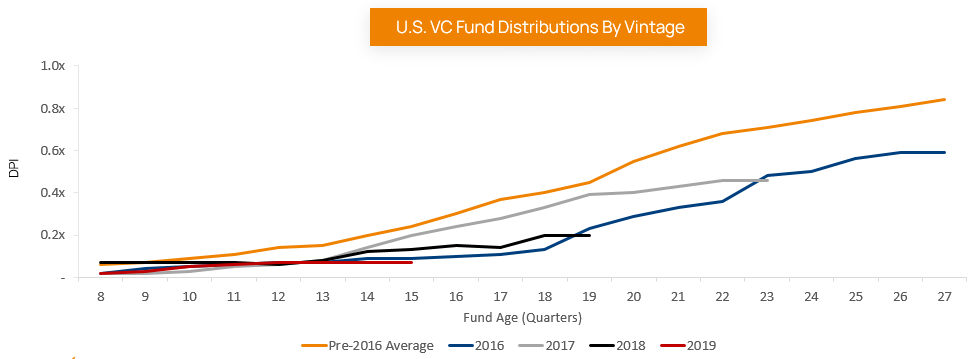

While the factors above make it clear that companies are in no rush to go public, it’s worth noting that seeing capital returned as a private company shareholder has been a less frequent occurrence over the last 10 years in general. It is common knowledge that companies are staying private for longer today, but this dynamic has led to venture funds realizing consistently lower DPI velocity vintage over vintage since 2016.

As pressures from (sometimes distressed) LPs mount to realize liquidity, it’s only natural for GPs to begin to explore other avenues vs. waiting for market conditions to improve or for companies to change their natural evolution. These GPs join a long list of startup employees who have the majority of their net worth tied up in company equity, creating a pricing dislocation that’s ripe for alpha generation.

At various phases of the economic cycle, LPs, GPs, and startup employees have exhibited a willingness to exercise patience, anticipating that a natural exit—be it through M&A or IPO—would materialize when the company is suitably positioned. However, with no clear line of liquidity in sight, patience has run thin.

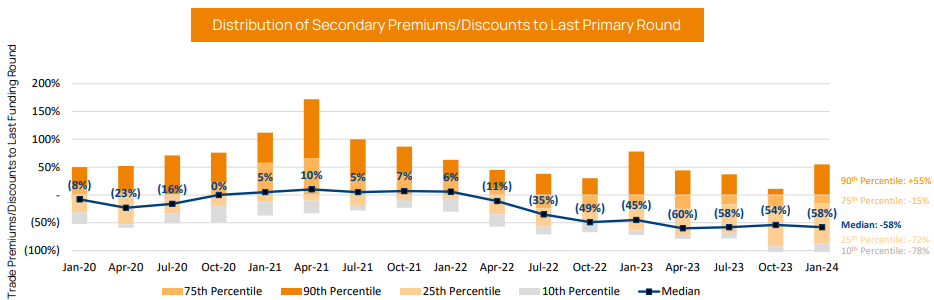

At the end of the year, the median secondary transaction occurred at a 46% discount to the valuation at the last funding round, while lower-tier companies transacted at a fifth of their prior valuations.

To be explicit, simply because a company is available at a deep discount to its latest, likely inflated, valuation, does not necessarily make it an attractive investment. However, shareholders’ urgent need for liquidity may drive them to sell at a discount to the company’s intrinsic value, in which case, we spot an opportunity.

Redefining Market Perceptions

The alignment of incentives is crucial for successful ventures. Shareholders in venture-backed startups historically demonstrated their alignment by holding and increasing their share in portfolio companies until a liquidity event occurred. This signaled support from employees and GPs to founders, even if it wasn’t always the tactical decision for their personal situation or portfolio.

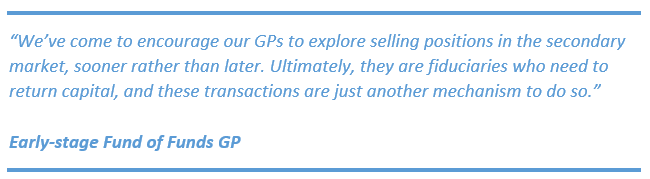

Recent data indicates that venture funds have been slow to return capital to shareholders. However, challenging market conditions have reminded GPs of their fiduciary duty to produce returns for limited partners. This has led to more GPs accessing the secondary market to realize distributions for their shareholders.

Founders have recognized this dynamic and many wisely took advantage of secondary transactions to secure liquidity during favorable times. However, most shareholders did not have the same opportunity. To incentivize employees and others, company-sponsored tender offers and structured liquidity events have become more common, eliminating the stigma associated with “selling early.”

And today’s market environment is much different than when we last saw founders rushing for liquidity. Today, rather than being opportunistic, these shareholders have run short of patience and decided to access the secondary market, despite terms now being more advantageous for buyers.

This shift in narrative is essential for the continued growth of the direct venture secondary market. With the stigma of “selling early” fading, we anticipate increased transaction volumes and values, leading to a healthier ecosystem with timely liquidity for all shareholders.

Navigating the Opportunity Set

As the aforementioned dynamics continue to evolve in the years ahead, we maintain that investors capable of offering requisite liquidity are strategically positioned to achieve significant returns. However, we emphasize that mere access to capital does not suffice to meet our definition of being “equipped”. Considering the current landscape populated by over 1,200 private unicorns, the industry at large may consider itself fortunate if even 25% of these entities exit for more than $1 billion.

Complicating matters further, the secondary market is characterized by opacity, rife with intermediaries of varying sophistication levels, no-information special purpose vehicles (SPVs), and intricate legal structures.

Much like in primary rounds, the value of relationships often carries weight in sourcing secondary deals. Connections forged with early-stage GPs or founders with whom one has shared boardrooms or planning sessions tend to yield the most enticing opportunities. Beyond deal sourcing, evaluating and pricing companies boasting hundreds of millions in revenue, intricate capital structures, and numerous disparate investors demands a distinct skill set and heightened discipline—attributes not always prioritized by momentum-chasing venture investors of previous cycles.

Given the nascent nature of these transactions, investor attention has predominantly centered on later-stage companies with a foreseeable path to liquidity within 2-4 years. This focus naturally shortens the investment horizon compared to traditional venture investments, enabling managers to realize tangible distributions in the initial four years of the fund’s lifecycle, in contrast to the 8+ years typical for primary venture funds.

The Path Forward

After a prolonged era of abundant capital, it’s evident that the highest-quality late-stage private companies have either secured ample external funding or are generating significant cash flow to support their growth and operations until the IPO stage. Consequently, the sole route to access these companies is through challenging and often opaque secondary transactions, wherein only those suitably equipped will gain unique exposure to this asset class.

The Mirae Asset U.S. Venture Team