As the world continues the long road of energy transition, it’s clear that the auto industry will lean heavily on electrification to do its part. Adoption is well underway here in the United States, but with EVs accounting for just 6.5% of new car purchases in the first half of 2023, there’s a long runway for growth. In fact, BNEF forecasts a 5x increase in new U.S. EV sales by 2030, driven by range improvement, more favorable pricing dynamics, and enhanced charging convenience.

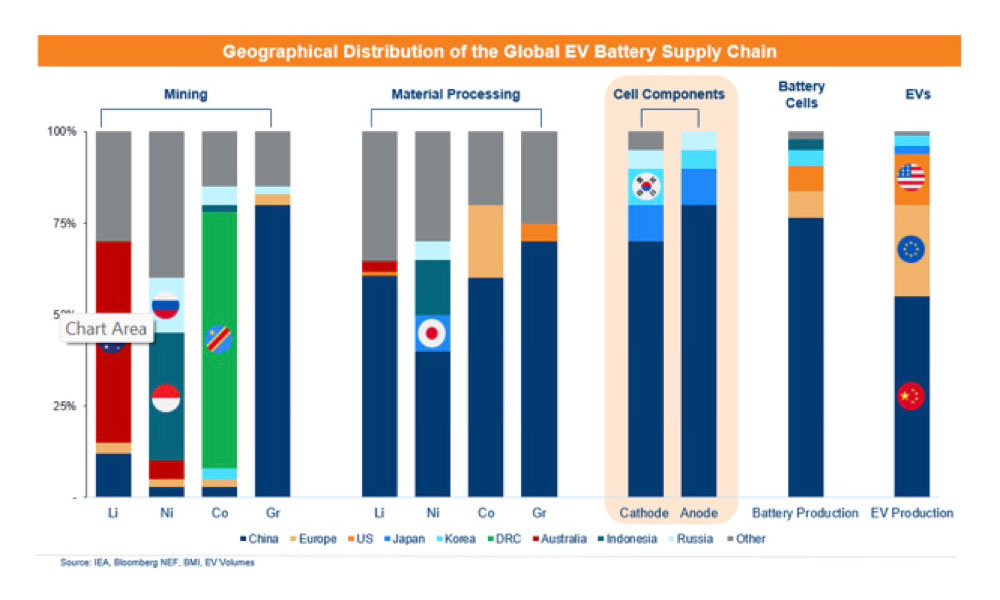

To prepare for the inevitable rush of demand, legacy North American OEMs are racing to modernize their supply chains. A critical component of the EV supply chain requiring foundation development is the battery segment. About three-quarters of lithium-ion batteries and battery components are manufactured in China, and without domestic investment in this segment, supply chains could be strained as the U.S. EV industry grows.

As such, strategic pieces of the U.S. economy are gearing up for a homecoming, safeguarding against potential geopolitical turbulence. Additionally, with 80% of a battery’s estimated cost originating overseas, building domestic recycling capabilities isn’t just an option—it’s paramount. The U.S. government echoes this sentiment, emphasizing the energy transition’s strategic importance with the passing of the IRA.

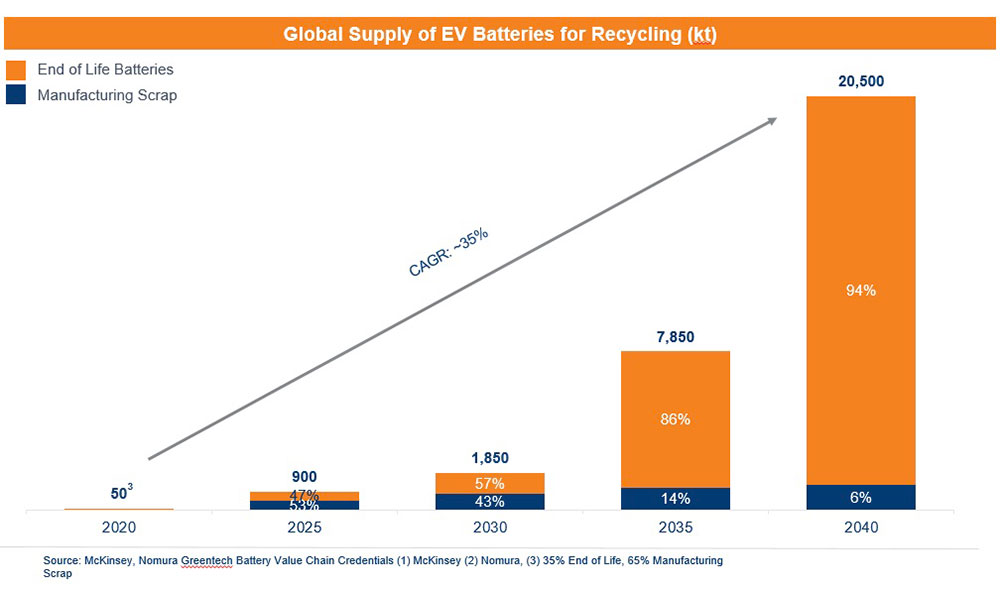

Today, a meaningful portion of cell manufacturer output does not meet stringent battery safety standards that are observed in the United States.

The result is an abundance of discarded material, referred to as “scrap,” which can account for as much as 30% of production. These high scrap rates, combined with increasing volumes of spent batteries, present a unique opportunity.

The result is an abundance of discarded material, referred to as “scrap,” which can account for as much as 30% of production. These high scrap rates, combined with increasing volumes of spent batteries, present a unique opportunity.

North American recycling facilities can capitalize on this trend by treating discarded materials and used batteries as “synthetic” mines. This approach not only presents a more environmentally friendly solution that reduces carbon footprints, but also offers a potentially cost-effective way to source battery materials. As EV production surges, scrap, along with aging batteries, will be crucial to feed recycling initiatives.

Enter Ascend Elements. Rather than focusing solely on recycling, a process that we believe will quickly be commoditized, Ascend has built a robust IP-protected process to extract and reconstruct the highest value materials in a battery cell. When benchmarked against its closest competitors, Ascend’s approach is not only more cost-effective and environmentally friendly but also yields battery cells with a remarkable 50% extended lifespan and an enhanced power capacity of 88%.

While we deeply value defensible IP, it’s the tangible commercialization of that IP that truly excites us. In our eyes, the early backing from key industry players is essential, as we foresee only a select few recycling companies to scale adequately to fulfill the demands of North American OEMs. The team’s establishment of alliances with key customers — both as a supplier of battery raw materials and sophisticated battery components — is a testament to its impressive traction to date.

Michael O’Kronley, Ascend Element’s CEO, has curated an impressive team from the auto, chemicals, and battery industries that we believe is perfectly suited to tackle this opportunity.

In our view, Ascend Elements is central to the evolution of North America’s energy transition. The combination of strong market demand, innovative technology, and an impressive customer base positions it as a critical player in the upcoming wave of change. Our commitment extends beyond mere investment; we see Ascend Elements as a pivotal part of the future North American OEM supply chain. For a detailed discussion on our perspective and the path forward, feel free to contact us at us.venture@miraeasset.com.